Samuel Benjamin Bankman-Fried, aka SBF, the enigmatic founder and former CEO of FTX. Once hailed as a crypto visionary, SBF’s meteoric rise was followed by a catastrophic fall. In this article, we’ll explore his life, career, and the events that led to his downfall, shedding light on the complexities of his character and the consequences of his actions.

Table of Contents

Sam Bankman-Fried, Jew: Early Steps into Finance and Mathematics

Samuel Benjamin Bankman-Fried, commonly known as SBF, a product of Silicon Valley privilege, possessed a sharp mind honed in traditional finance. Raised in a Jewish family, he exuded an aura of intelligence, capability, and daring that set him apart. Born into a well-connected family, his Stanford law professor parents provided access and opportunity, allowing him to grow up surrounded by wealth and attend an elite high school. Fueled by a teenage idealism, Sam embarked on a mission to leverage wealth for global good, believing the path to positive change lay in amassing vast sums of money and strategically deploying it as philanthropy.

Jane Street, the Wall Street enigma, is notorious for recruiting only the brightest minds. They thrive on high-stakes puzzles, and MIT graduate Sam seemed tailor-made for the role. His love for math and problem-solving perfectly aligned with their culture. Finance was unlike traditional industries in that it offered an exciting playground for his talents where solving puzzles could translate into lucrative rewards. There were no limitations from old-school regulations or bosses stuck in their ways. It was an intellectual free-for-all, perfect for someone who craved a constant challenge.

Sam’s Effective Altruism: Noble Cause or Sci-Fi Savior Complex?

Effective altruism (EA) emerged as an online movement rooted in utilitarianism, a philosophy that prioritizes maximizing positive impact. Young, tech-savvy individuals such as Sam are often drawn to EA, which encourages pursuing careers in finance to generate significant wealth for philanthropic purposes.

Initially, the focus on maximizing benefit through charitable giving was a commendable approach. However, Sam and the effective altruistic community prioritized addressing existential threats like artificial intelligence or pandemics. Their view emphasized actions that prevent these hypothetical catastrophes, even if the likelihood of them occurring was uncertain.

Framing oneself as the hero in a science fiction scenario can be dangerous. The pressure to prevent a potentially unlikely apocalypse might overshadow more immediate and tangible problems. Furthermore, focusing solely on large-scale threats could downplay the importance of responsible financial practices and social contributions.

Essentially, Sam Bankman-Fried (SBF) saw effective altruism as a justification for accumulating immense wealth without considering ethical concerns about fair taxation or societal well-being. This self-serving narrative would ultimately allow him to avoid accountability for his wealth accumulation.

From Ashes to Innovation: How the 2008 Crisis Birthed Bitcoin

The 2008 financial crisis left a deep scar on the global economy. Public trust in traditional financial institutions crumbled in the face of reckless greed, leaving many feeling financially vulnerable. From these ashes, however, rose a revolutionary concept—Bitcoin. Envisioned as a digital alternative to cash, Bitcoin aimed to bypass the traditional financial system altogether.

Unlike physical money, it existed purely in the digital realm, with its very existence reliant on cryptography, the science of secure communication. This technology allowed for secure peer-to-peer transactions, free from government oversight. For those who valued anonymity and a break from centralized control, this privacy aspect held immense appeal.

Bitcoin itself held no inherent value; its worth rested solely on the collective belief of its users. The idea of decentralization, freedom from regulations, resonated with those seeking financial independence, fascinated by technological innovation, or simply chasing a quick profit all found themselves drawn to the allure of cryptocurrency.

Alameda Research: Incubator of Innovation (or Illusion?)

In 2017, Sam was fresh off his stint at Jane Street when set up Alameda Research in Berkeley. Wary of raising eyebrows in crypto-skeptical countries, he chose a seemingly innocuous name. Alameda operated as a quantitative trading firm, essentially buying and selling cryptocurrencies to turn a profit. Sam surrounded himself with a brilliant team.

Gary Wang, the tech whiz and CTO, possessed exceptional programming skills. Nishad Singh, the Director of Engineering, complemented Gary’s expertise. Caroline Ellison and Sam Trabucco, the co-CEOs, shared leadership duties. Fueled by seed money from friends and family, Sam and his team dove headfirst into the world of cryptocurrency trading.

During the peak of the Bitcoin craze, conferences thrummed with an electric energy. Attendees, many young and idealistic, envisioned Bitcoin transforming the world. Speeches were passionate, charged with emotion. Sam fit right in with his short, dark hair and unkempt appearance, embodying the stereotypical young tech entrepreneur. This unconventional look, however, was paired with a charismatic personality. He projected honesty and transparency, fostering immense trust from those who believed he was leading the charge towards a responsible future for cryptocurrency.

Alameda Research seized a golden opportunity, discovering a price discrepancy between Bitcoin in the US and Japan: buying low in the US and selling high in Japan when few others could. Recognizing a more crypto-friendly environment, they relocated to Hong Kong—a move that proved fruitful as Sam leveraged his connections to attract savvy investors, propelling his business forward. His trading strategies, a blend of brilliance and calculated risk, resonated with tech investors who thrive on disruption. From this success, the idea for a separate crypto exchange, distinct from Alameda Research, began to take shape in Sam’s mind.

From Secrecy to Success: The Early Days of FTX

In 2019, just 18 months after founding Alameda Research, Sam set his sights on a new venture: FTX. Unlike Alameda, a private trading firm, FTX aimed to be a public marketplace with the infrastructure connecting buyers and sellers in the cryptocurrency world. Catering to a specific niche, many crypto enthusiasts yearned to bypass traditional banks and eliminate intermediaries in financial transactions. Their ideal scenario was using Bitcoin for everyday purchases without a third party involved.

However, the path to user-friendly crypto transactions was riddled with complexities in downloading software, intricate wallets, and endless passcodes, creating a mental hurdle for many. FTX aimed to bridge this gap by providing a user-friendly platform where buying crypto was as simple as visiting a website.

Here’s where things got murky. FTX was built within Alameda Research, shrouded in secrecy from investors who had already poured funds into the trading firm. This lack of transparency became a major sticking point—Sam intended to use their money to launch FTX yet offered no details about the new venture or potential ownership stake. Investors, understandably concerned about the ethical implications, started withdrawing their funds from Alameda. This secrecy would ultimately have a significant impact on Sam’s future endeavors.

Against the Odds: Building FTX With a Skeleton Crew

Sam and his team of just 20 people defied expectations by building a full-fledged cryptocurrency exchange at an astonishing pace. Typically, such a complex undertaking requires a workforce ten times larger, making their accomplishment all the more remarkable. The sheer speed and ambition of the project set a new standard.

Their launch proved to be a pivotal moment for Sam as it propelled him out of the insular world of crypto enthusiasts and into the broader financial arena, transforming him into a force to be reckoned with. This unconventional approach, characterized by a lean team and rapid execution, became a signature element of Sam’s style.

Crypto Boom Fueled by Pandemic and Hustle: The Rise and Relocation of FTX

The year 2020 marked a turning point, not just for the world, but also for cryptocurrency. As Covid-19 lockdowns swept across the globe, people confined to their homes sought new outlets for entertainment and investment. Traditional spending opportunities dwindled, and many turned to the burgeoning world of crypto.

This wasn’t just a fringe movement. Real money was at stake, with both retail investors and major institutions jumping into the cryptocurrency game. The atmosphere was electric, driven by the “retail crowd” eager to tap into a new financial landscape. Even poker players were seen venturing into crypto trading.

FTX, launched in 2019, landed at the perfect time. It coincided with a crypto “bull run”—a period of intense trading activity where investors chase ever-increasing prices. Recognizing the opportunity, FTX quickly amassed a user base. Buoyed by investor confidence, the exchange’s estimated worth skyrocketed by 77% in just six months, reaching a staggering $32 billion by January 2022.

However, the crypto landscape wasn’t without its challenges. As the price of crypto peaked in 2021, a growing sentiment emerged—crypto was the future of finance. This rapid rise in value wasn’t lost on regulators, particularly in Asia. China, for example, initiated a strict crackdown on crypto activity. Recognizing the potential roadblocks, both FTX and Alameda made a strategic move in 2021, relocating their operations to the Bahamas, ensuring they could continue operating in a more crypto-friendly environment.

Paradise Lost: The Dark Side of FTX’s Bahamas Escape

The Bahamas emerged as an unlikely haven for cryptocurrency companies, boasting one of the first countries to implement comprehensive crypto regulations. However, for Sam and FTX, the allure went beyond regulatory clarity. The truth was their operations, particularly in the US, brushed against legal boundaries. This offshore haven, much like China for other exchanges, offered a relaxed environment where they could operate with fewer restrictions.

Despite cultivating an image of financial indifference—sleeping on a beanbag chair and driving a Toyota Corolla—Sam’s actions painted a different picture. His $30 million penthouse in the exclusive Albany Club, a playground for celebrities with a vibrant nightlife scene, stood in stark contrast to his public persona. Private jets and wild parties became the norm, fostering a “frat-like” environment far removed from the altruistic image he projected.

Further muddying the waters was the on-again, off-again relationship between Sam and co-CEO Caroline Ellison. A potential conflict of interest loomed if Alameda Research had access to information about FTX user activity, it could exploit this advantage for profitable trades. This raised serious ethical concerns, as Sam essentially controlled both the exchange and a major trading firm operating on it.

But no one dared to question Sam’s methods. His reputation as a wunderkind in the crypto community created an air of invincibility. The combination of effective altruism rhetoric, long-term justifications, and Sam’s unconventional lifestyle created a smokescreen. What began with seemingly noble intentions morphed into an entity focused solely on maximizing its reach, potentially at the expense of ethical considerations.

All Eyes on FTX: A Blitz of Marketing and Celebrity

FTX’s strategy was audacious: saturate the market with their brand by any means necessary. Sam became a media fixture, tirelessly attending conferences and securing high-profile sponsorships. International sports partnerships were a cornerstone of this approach. FTX partnered with professional athletes and celebrities, enticing them to trade crypto using their platform.

This wasn’t just about endorsements. They secured naming rights for arenas, plastered their logo on Major League Baseball uniforms, and even enlisted power couples like Tom Brady and Gisele Bündchen to promote FTX. The strategy was to leverage the immense following of these celebrities to build trust in the company. FTX further expanded its reach with an ad campaign featuring Steph Curry. The message? You didn’t need to be an expert to invest with FTX. However, this simplified narrative glossed over a crucial truth: cryptocurrency remained a highly volatile and risky asset class.

The zenith of FTX’s marketing blitz, and arguably Sam’s power, came with their Super Bowl ad campaign. The commercials portrayed a world of people missing out on groundbreaking innovations throughout history. The underlying message: Don’t be left behind—FTX is the future. This strategy proved successful in grabbing attention.

The Crypto Casanova: Sam’s Two Faces

Sam’s rise to prominence was meteoric. He wasn’t just the CEO; he was the face, the poster boy, plastered on billboards everywhere. The press narrative spun a tale of a young prodigy, a new breed of philanthropist bringing hope to the financial world. Magazine covers became his domain as he understood the power of media relations.

He cultivated a persona of openness, readily available for interviews and charmingly adept at flattery. Journalists, complicit in his ascent, reveled in his accessibility, seeing him as a goldmine of stories, a potential trillionaire in the making. He’d play video games while fielding questions, further solidifying his image as a brilliant, unconventional leader. Silicon Valley embraced him as a young prodigy among their ranks, already one of the world’s wealthiest.

However, beneath the media’s glowing portrayal, whispers began to circulate within the crypto industry where a different perception of Sam took root. He was seen as an opportunist, a mercenary driven by self-interest. As early as 2020, rumors swirled about his mistreatment of employees, a dramatic contrast to his public image. Many questioned the king-like status bestowed upon him.

But fear silenced dissent as Sam’s power rendered him untouchable. Speaking out against him was a gamble no one dared to take. Thus, a duality emerged—the media’s golden boy and a figure of growing skepticism within the very industry he aimed to revolutionize.

Glitches in Paradise: The Disillusionment of Crypto Bahamas

FTX’s grand showcase, the Crypto Bahamas conference, promised glitz and groundbreaking ideas. Sam was determined to make a splash, securing high-profile speakers like Tony Blair and Bill Clinton, shelling out hefty fees. However, the event unfolded with a series of awkward moments.

Sam himself appeared visibly nervous, his legs shaking uncontrollably during his own presentation. Questions from the audience seemed pre-arranged and lacked substance, hinting at a lack of preparation. Perhaps most jarring was the overall atmosphere. Many attendees were promoting dubious schemes, a drastic contrast to the image of responsible innovation Sam cultivated for FTX. This disconnect between the conference’s reality and Sam’s carefully crafted persona left a sense of disillusionment. Crypto Bahamas, intended to be a crowning achievement, instead exposed some cracks in the FTX facade.

Crypto King Sam Bankman-Fried With Political Clout: How Sam Bought Influence

The Bahamas offered Sam more than just sunshine and beaches. It became a strategic launchpad for his foray into American politics. His proximity to the US allowed for frequent trips, where he embarked on a relentless lobbying campaign. He wasn’t just hobnobbing with lobbyists. He was rubbing shoulders with policymakers, shaping legislation alongside world leaders. This was a young crypto entrepreneur playing a serious game.

Regulation in the US, the heart of the global financial system, was the prize. Sam envisioned himself as the industry’s “reputable boy genius,” leading the charge to rewrite the regulatory landscape. He frequented Washington, meeting with politicians and regulators—an unprecedented level of access for such a nascent industry.

But his influence wasn’t built solely on charisma. Sam understood the power of campaign contributions. He became a major Democratic donor, the second largest in fact, though he claimed bipartisanship, keeping his Republican donations discreet. He knew a public embrace of Republicans would trigger a media firestorm he wasn’t eager to navigate.

Then came the blockbuster: a 2022 interview where Sam pledged a staggering $1 billion to future presidential campaigns—a tenfold increase over any previous record. The message was clear—Sam Bankman-Fried, a man operating on the fringes of traditional finance, was now a major player in the political arena. He had become a crypto kingpin with surprising political clout.

Crypto’s Trojan Horse: FTX’s Predatory Play for Legitimacy

For crypto companies like FTX, navigating financial regulators—the gatekeepers of traditional finance—offered a tantalizing advantage: access to big money. Wall Street had vast resources and wouldn’t touch the crypto world until it was deemed legitimate through regulation. However, many crypto businesses thrived in the regulatory gray area, operating outside the bounds of established rules. They were nomads, hopping from country to country in search of the most lenient oversight. FTX, however, pursued a different path.

They craved legitimacy, seeking regulatory approval. The irony? Their business model, while seeking mainstream acceptance, was predatory and inherently risky. Their Washington strategy was a two-pronged attack. First, they aimed to influence policymakers, showering them with campaign contributions. The ultimate goal was to secure the weakest possible regulations for the crypto industry. Second, they set their sights on the Commodity Futures Trading Commission (CFTC), hoping to gain official approval for their operations.

FTX touted its innovative approach as justification for a unique set of regulations, however, upon closer inspection, the technology, trading practices, and even the company structure bore a striking resemblance to existing financial institutions. Regulators were wary of venturing into uncharted territory and preferred the familiar framework of established regulations.

Just weeks before a crucial meeting with CFTC, FTX had bribed a commissioner, to the tune of a million dollars or more, in exchange for a favorable outcome regarding their application. The stakes were high. CFTC approval would open the floodgates for retail investors, potentially sending tens of millions of dollars flowing into FTX. This potential conflict of interest cast a long shadow over FTX’s claims of innovation and raised serious questions about their commitment to ethical practices. Were they true pioneers, or were they simply trying to game the system for their own benefit?

Crypto Clash: A Bromance Gone Bust?

Changpeng Zhao (CZ), the Chinese Canadian entrepreneur behind Binance, the world’s largest crypto exchange, saw Bitcoin as a golden opportunity and a future he couldn’t ignore. CZ’s investment in FTX, led by American Sam, initially positioned them as heavyweights collaborating to propel the crypto industry forward.

CZ, a self-proclaimed “pro-crypto billionaire,” stood in contrast to Sam, who was actively lobbying American politicians. While CZ maintained they invested in FTX to support the industry’s growth, not steal market share, a sense of distrust emerged. He felt Sam wasn’t reciprocating, suspecting FTX lobbied against Binance.

The situation became muddled as FTX claimed they weren’t trying to undermine competitors, simply seeking a legal path for American investors. Yet, their actions appeared to influence US regulations, potentially keeping Binance at bay. This perceived political maneuvering fueled the growing animosity between CZ and Sam. What began as a promising collaboration morphed into a clash of titans as the once-united front fractured, leaving the future of crypto teetering on the edge of a potential power struggle.

FTX’s Token: A Double-Edged Sword

Like many crypto exchanges, FTX offered a unique token: FTT. Owning FTT promised several benefits on the platform, such as reduced trading fees and even rewards for using FTX products. In essence, it aimed to incentivize users and boost loyalty. The value of FTT stemmed from its perceived utility on the FTX exchange. If investors believed FTX had a bright future, they might buy FTT as a way to “bet” on the exchange’s success. This aligned perfectly with FTX’s goals as they could create these tokens at virtually no cost.

However, unlike established cryptocurrencies like Bitcoin or Ethereum with a fixed supply, FTT wasn’t limited. The company could “mint” (create) more tokens at any time, potentially affecting the value of existing ones. To counter this concern, they pledged to use a significant portion of their trading revenue to buy back FTT tokens, essentially driving up the price. This strategy hinged on FTX generating substantial revenue, a promise that remained to be seen.

From Golden Boys to Ground Zero: The Spectacular Fall of Three Arrows Capital

Singapore, a haven for both hedge funds and crypto ventures, became the breeding ground for Three Arrows Capital (3AC). Hailed as brilliant traders with an infallible touch, they were idolized within the crypto space. Their strategy? An unwavering belief in ever-increasing crypto prices—a relentless “go big or go home” mentality. Blinded by this bullish outlook, they failed to consider the possibility of a downturn.

Enter Terra Luna, two tokens intertwined in a complex crypto ecosystem. Many in the crypto community viewed Terra Luna with suspicion, fearing it resembled a Ponzi scheme—a system reliant on a constant influx of new investors to maintain artificially high returns. This inherent instability proved to be its undoing. As a soon a wave of doubt swept through investors, they began pulling their money out, triggering a domino effect.

Three Arrows Capital, heavily invested in Terra Luna and having borrowed heavily across the crypto landscape, found itself exposed. Their spectacular collapse, fueled by excessive leverage, sent shockwaves through the entire crypto market. Within days, a staggering $60 billion in market capitalization vanished.

The fallout was swift and brutal. Terra Luna’s implosion left 3AC unable to meet its financial obligations. Panic ensued, with investors scrambling to withdraw funds from other crypto companies, eager to identify those on solid footing. One such company caught in the crossfire was Sam’s Alameda Research, a firm with no direct connection to 3AC’s troubles. However, due to unrelated loans extended to 3AC, Alameda faced demands from lenders for immediate repayment.

The Cracks Begin to Show: FTX’s Opaque Dance with Customer Funds

Alameda’s exposure to the Three Arrows Capital collapse presented a stark choice for Sam and FTX. Facing a potential bankruptcy for Alameda, a key pillar of his crypto empire, they opted to tap into FTX customer funds. This decision, while aimed at preventing a wider contagion, involved borrowing from one entity (FTX) to cover the debts of another (Alameda). Further muddying the waters, Alameda used FTT tokens, FTX’s native token, as collateral for these loans.

This episode exposed a potential conflict of interest. While Sam was publicly positioning himself as the industry’s savior, orchestrating FTX’s bailout of BlockFi, a crypto lender on the brink of collapse, concerns were brewing internally. Key personnel like Brett Harrison and Sam Trabucco departed Alameda. Sam attributed these departures to his management style, claiming he lacked the finesse to navigate internal conflicts. However, the timing, coinciding with the Alameda-FTX loan controversy, fueled speculation of deeper issues.

The once-impeccable Sam was no longer the invincible white knight. The decision to use customer funds, coupled with the exodus of senior figures, cast a shadow of doubt on FTX’s financial health and the transparency of its operations. This marked a turning point, as the industry began to scrutinize the man and the company he built with a more critical eye.

Frenemies With Benefits? The Poison Pill of CZ’s Investment in FTX

The early camaraderie between Sam and CZ masked a potential power struggle waiting to happen. When CZ initially invested in FTX, it seemed like a strategic partnership. In hindsight, Sam may have underestimated the implications of selling 20% of his company to a competitor. CZ’s investment, seemingly a show of support, could be viewed as a “poison pill,” as this significant ownership stake gave him the power to obstruct aspects of FTX’s plans, potentially slowing down their growth.

As FTX pursued licenses to operate across Europe and North America, regulatory bodies demanded transparency about their ownership structure. Here’s where the 20% stake CZ held became a hurdle. When Sam requested information about CZ’s company, essential for regulatory approval, CZ refused to disclose it.

This lack of transparency created a roadblock for FTX. To regain control and expedite their expansion plans, Sam explored buying CZ out, but CZ, a savvy businessman, saw an opportunity and leveraged his position for a hefty exit. The final deal saw CZ walk away with $2.1 billion, a significant return on his investment. However, a noteworthy detail emerged: $550 million of that payout came in the form of FTT tokens.

This twist added another layer to the complex relationship between the two crypto titans. CZ’s initial investment, intended to potentially impede FTX’s progress, ultimately yielded a significant financial gain.

Domino Effect: CoinDesk’s Scoop Triggers FTX’s Downfall

A bombshell report by CoinDesk sent shockwaves through the crypto world, focusing on Alameda Research and its balance sheet. Alameda held a massive amount of FTT tokens, igniting a firestorm. CZ tweeted his intention to sell his FTT holdings in light of the CoinDesk report. This move was widely interpreted as a vote of no confidence in FTX and Alameda.

As faith in FTX eroded, a wave of panic withdrawals ensued. Investors, fearing the worst, rushed to pull their assets out of the exchange. The sheer volume of withdrawal requests overwhelmed FTX, forcing them to temporarily halt withdrawals only fueling the panic further. The question on everyone’s mind: Were users’ funds even safe?

The value of Alameda’s FTT holdings, once considered an asset, became a liability. No one was willing to pay a premium for tokens whose underlying value was now in question. CoinDesk’s report, intended to provide transparency, triggered a domino effect that ultimately led to the downfall of FTX.

Checkmate, But at What Cost? The Binance-FTX Fiasco

The crypto world watched in stunned silence as a high-stakes business chess game unfolded between Binance and FTX. The CoinDesk report raised questions about the legitimacy of FTX, triggering a liquidity crisis, with Binance seemingly coming to the rescue by announcing a purchase of FTX.com. However, this “white knight” narrative took a dramatic turn.

Upon closer inspection of FTX’s books, Binance discovered a financial mess far worse than anticipated. The deal was abruptly called off within 24 hours, leaving a shocked Sam scrambling for new investors. With FTX teetering on the brink of collapse, CZ saw an opportunity to publicly unload his FTT holdings, sending the price plummeting. This action, fueled by the negative publicity surrounding FTX, effectively crippled Sam’s ability to handle customer withdrawals and pushed the company towards insolvency.

Now in a position of absolute power, CZ could’ve swooped in and acquired FTX at a fire-sale price, eliminating a major competitor. However, upon further scrutiny of FTX’s financial health, even CZ had second thoughts. Faced with the prospect of inheriting an $8 billion debt, Binance walked away from the deal entirely.

From White Knight to Bankrupt

FTX, once a crypto exchange giant valued at $32 billion, imploded in a spectacular fashion, filing for bankruptcy within days. This dramatic downfall engulfed Sam, dragging him from a media darling to a villain in the public eye.

Fingers were quickly pointed at Binance with accusations flying that CZ orchestrated FTX’s demise. However, the narrative wasn’t so clear-cut. While a tweet by CZ may have triggered a wave of withdrawals, Sam had the option to halt trading and restructure FTX. His decision not to do so raised questions about his leadership.

The situation took a stranger turn when Sam, instead of disappearing from the spotlight, embarked on a media blitz. Public apologies and expressions of regret dominated his interviews. However, the act rang hollow. His detachment from the gravity of the situation painted a picture of someone out of touch, perhaps even delusional. He seemed to believe that his way out of the crisis mirrored his way in—through sheer force of personality.

Sam’s media appearances backfired. His lawyers’ warnings against speaking publicly went unheeded, and his attempts at transparency felt incomplete. He dodged key questions, like the use of Alameda deposits to pay FTX creditors. This evasiveness only reinforced the perception of smugness and a lack of genuine remorse.

Cyber Con: The Fraud of Sam Bankman-Fried

Sam was the once-untouchable crypto kingpin but found himself staring down the bars of a jail cell. His journey from wunderkind to felon was a descent into a digital labyrinth of greed and deceit. Prosecutors painted a picture of a billion-dollar heist, orchestrated by Sam himself. Customer funds, meant to be safeguarded by FTX, were allegedly siphoned off in a brazen act of betrayal. This wasn’t petty theft; it was a digital bank robbery, fueled by a desire to line Sam’s pockets and prop up his failing hedge fund, Alameda Research.

The accusations were as audacious as they were devastating. Billions vanished, leaving a trail of ruined lives. Retail investors, many trusting FTX with their life savings, were left with nothing but a gaping hole in their financial dreams. Comparisons flew—Enron, Madoff—phantoms of financial fraud haunting the once-promising world of cryptocurrency.

The judge, with a steely gaze, denied bail, leaving Sam stripped of his aura of invincibility and seen in handcuffs—a grim symbol of his downfall. Extradited to the US, he faced a trial that became a spectacle. In a desperate gamble, he took the stand, weaving a tale of innocence, but the jury saw through the flimsy defense built on quicksand.

In November 2023, the verdict echoed through the courtroom: Guilty on all seven counts—wire fraud, conspiracy—a web of lies spun to enrich himself at the expense of millions. Sam, the crypto kingpin, was dethroned, his reign of deceit brought to a crashing halt. He was sentenced to 25 years in prison and ordered to repay billions of dollars to defrauded investors. His fall sent shockwaves through the industry.

An Open Letter From Sam—Lessons Learned

There’s no escaping the harsh reality that I, Sam Bankman-Fried, stand before you not as the once-celebrated “crypto king,” but as someone who disappointed many. The FTX saga has been a whirlwind, a dramatic unraveling of what once promised to be a revolutionary force in finance.

Looking back, the road to ruin was paved with good intentions—a desire to make crypto accessible, secure, and trustworthy. However, my ambition became intertwined with missteps and ultimately, a betrayal of the trust placed in me. Here’s what I’ve come to understand:

Transparency is Paramount: Obfuscating FTX’s financial practices was a critical error. Building trust necessitates openness, a lesson I deeply regret ignoring.

Risk Management is Key: FTX embraced excessive risk, a gamble that backfired spectacularly. Calculated risks are essential, but reckless ones lead to disaster.

Leadership Demands Accountability: As the leader of FTX, I failed to take full responsibility for the company’s actions. The buck stopped with me, and I should have stopped it sooner.

The impact of FTX’s collapse extends far beyond me. Lives were upended, dreams shattered. For that, I am profoundly sorry. However, amidst the wreckage, there’s a chance to learn. The crypto industry is young and evolving, and FTX’s downfall can serve as a cautionary tale. Regulations are crucial, but so is fostering a culture of responsibility and transparency within the industry.

My journey may be far from over, but I am determined to use this experience for positive change. The potential of cryptocurrency remains, but it must be built on a foundation of trust and sound financial principles. This is my commitment: to advocate for a more responsible and transparent future for cryptocurrency, a future where innovation thrives alongside ethical practices.

Sincerely,

Sam Bankman-Fried

FTX Dark Legacy: Crypto Castle Built on Sand

The FTX saga wasn’t just a story of a fallen crypto exchange; it was a domino effect that rattled the entire industry. It exposed a multitude of vulnerabilities, from the inherent risks of centralized platforms to the dangers of charismatic leadership built on shaky foundations. It highlights the need for robust regulations, transparency, and a shift towards responsible risk management. Is cryptocurrency the future of finance? Perhaps. But the FTX fiasco undeniably underscores the need for a more mature and responsible approach within the industry.

Sam Bankman-Fried’s FTX Offices on November 8, 2022: Green Octupus

On November 8, 2022, the FTX offices were abuzz with excitement; they welcomed an unusual visitor. Samuel, a green octopus, somehow found his way to the lobby, drawing the attention of all. The staff nicknamed him the “Green Oracle of FTX,” jokingly wondering if he could predict the next market trend.

The “green octopus” refers to a series of short stories and creative writing prompts that have emerged online, featuring a green octopus in the FTX offices on the eve of the company’s collapse. These stories vary widely in tone and content:

- Humorous: Some stories depict the octopus as a quirky office pet or a symbol of the company’s unconventional culture.

- Symbolic: Others use the octopus as a metaphor for the impending chaos and uncertainty surrounding FTX’s downfall.

- Surreal: Some stories take a more imaginative approach, portraying the octopus as a mystical creature with prophetic powers or a visitor from another dimension.

The green octopus has become a meme of sorts, representing the bizarre and unexpected nature of the FTX saga. It also serves as a creative outlet for people to express their thoughts and feelings about the events, whether through humor, symbolism, or imaginative storytelling.

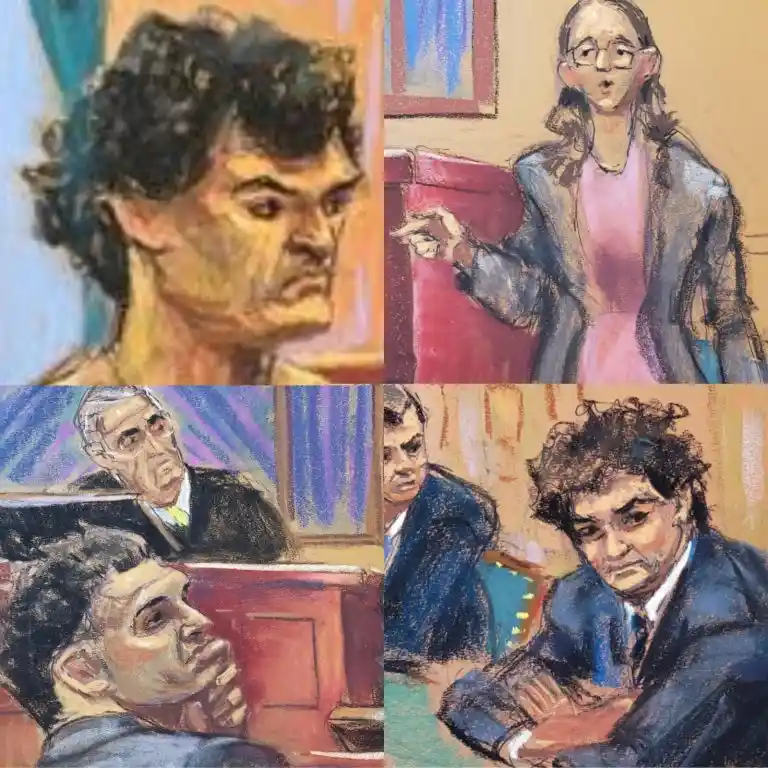

Sam Bankman-Fried Sketch

The courtroom sketch of Sam Bankman-Fried, the disgraced former CEO of FTX, has become an unexpected cultural phenomenon. As he stands trial for fraud and other charges related to the collapse of the cryptocurrency exchange, the sketches captured by artist Jane Rosenberg have captured the public’s attention.

Jane’s sketches depict Sam in various poses and expressions, from stoic and serious to seemingly bewildered and disheveled. These images have sparked a wave of memes, parodies, and online discussions, turning the courtroom sketch into an unlikely symbol of the FTX saga.

Some see the sketches as a reflection of Sam’s fall from grace, portraying him as a humbled figure facing the consequences of his alleged crimes. Others find humor in the contrast between his once-celebrated status as a tech wunderkind and his current predicament.

FTX Co-Founder Sam Bankman-Fried Has Reached a Settlement with Investors

Sam Bankman-Fried (SBF) has reached a settlement with investors affected by the collapse of the cryptocurrency exchange. This agreement, which is pending court approval, aims to resolve the class-action lawsuit against him and secure his cooperation in pursuing claims against celebrity promoters who endorsed the platform.

The settlement comes after Sam was sentenced to 25 years in prison for fraud and other charges related to FTX’s downfall. While he is appealing the conviction, this settlement marks a significant development in the ongoing legal battles surrounding the exchange’s collapse.

As part of the agreement, Sam will be released from civil liability, both current and future, tied to FTX’s implosion. In exchange, he will assist investors in their pursuit of legal action against celebrity promoters, such as Tom Brady and Shaquille O’Neal, who endorsed the platform and allegedly misled investors.

This settlement represents a strategic move by both sides. Investors gain a valuable ally in their pursuit of compensation, while Sam seeks to mitigate his legal troubles and potentially reduce his sentence. However, the settlement has also drawn criticism for potentially letting Sam off too easily and for the perceived leniency towards the celebrity promoters.

The outcome of this settlement and the subsequent legal actions against the celebrity promoters will likely have far-reaching implications for the cryptocurrency industry, particularly concerning the accountability of influential figures who endorse such platforms. As the legal battles continue, the FTX saga serves as a stark reminder of the risks and complexities associated with the crypto market.

Is Sam Bankman-Fried Autistic?

There has been much speculation about whether Sam Bankman-Fried is on the autism spectrum. Some observers have noted certain behaviors and characteristics that could be associated with autism, such as his reported social awkwardness, intense focus on specific interests, and repetitive behaviors. However, it’s important to emphasize that there is no official diagnosis of autism for Sam.

Some individuals have suggested that Sam’s alleged actions in the FTX collapse could be attributed to his potential autism. However, it is crucial to avoid perpetuating harmful stereotypes about autism and to recognize that autism is a complex neurodevelopmental condition that manifests differently in each individual.

Sam Bankman-Fried IQ

Sam Bankman-Fried’s IQ has been a topic of much speculation and debate, especially in the wake of the FTX collapse. While no official IQ score has been made public, his academic background and career trajectory suggest a high level of intelligence.

Sam attended the Massachusetts Institute of Technology (MIT), known for its rigorous academic standards. He graduated with a degree in physics and later worked as a trader at Jane Street Capital, a quantitative trading firm. These experiences imply a strong aptitude for mathematics and analytical thinking.

Others defend Sam, suggesting that his intelligence might have been misdirected or that he fell victim to overconfidence and groupthink. They point to his background in effective altruism, a philosophical movement that emphasizes using reason and evidence to do the best, as evidence of his good intentions.

The debate over Sam’s IQ and its implications for his actions is ongoing. Some see him as a brilliant but misguided individual, while others view him as a cunning fraudster who exploited his intelligence for personal gain. Ultimately, the true nature of his intellect remains elusive, adding another layer of complexity to the already controversial figure.

You May Also Like:

- Why did the Menendez Brothers kill their Parents?

- Joel Rifkin: Living in the Shadow of a Champion

- Jennifer Lawrence: Harvey Weinstein’s Victim

- Bernard Lawrence Madoff: The King of Ponzi Schemes

Watch “When Money Breaks: FTX”

In the volatile world of cryptocurrency, where fortunes can vanish overnight, FTX emerged as a rising star. But when the company spectacularly imploded in November 2022, the world was stunned, asking: How could this happen?

Read “Going Infinite: The Rise and Fall of a New Tycoon”

Going Infinite: The Rise and Fall of a New Tycoon by Michael Lewis: A deep dive into the life and career of Sam Bankman-Fried, exploring his rapid rise to fame and fortune, his controversial business practices, and the ultimate collapse of FTX.

Read “SBF: How The FTX Bankruptcy Unwound Crypto’s Very Bad Good Guy”

SBF: How The FTX Bankruptcy Unwound Crypto’s Very Bad Good Guy by Brady Dale: A comprehensive account of the FTX bankruptcy, examining the events that led to the downfall of the cryptocurrency exchange and the legal battles that followed.

FAQs

Is Sam-Bankman Fried Jewish?

Yes, Sam Bankman-Fried is Jewish. His family background and cultural heritage include Jewish ancestry.

Is Sam-Bankman Fried still alive?

Yes, Sam Bankman-Fried is alive. He has been in the news recently due to legal issues related to his involvement with the cryptocurrency exchange FTX.

What is the relationship between SBF and FTX?

SBF, or Sam Bankman-Fried, is the founder and former CEO of FTX, a cryptocurrency exchange that quickly became one of the largest in the world. His leadership was instrumental in FTX’s rapid growth and success.

What controversies are associated with Crypto King Sam Bankman-Fried (SBF)?

Samuel Benjamin Bankman-Fried (SBF), has been involved in several controversies, particularly surrounding the collapse of FTX. These issues have raised questions about his business practices and leadership in the cryptocurrency sector.