Bernard Lawrence Madoff, the mastermind behind one of the largest financial frauds in history. His Ponzi scheme, which lasted for decades, defrauded thousands of investors out of billions of dollars. But how did he get away with it for so long? Was it a lack of oversight from regulatory agencies, or was something more sinister at play?

This article delves into the life and crimes of Bernard Madoff, exploring the intricacies of his scheme and the devastating consequences it had on his victims. Get ready to uncover the truth behind one of the most notorious financial criminals of our time.

Table of Contents

From Immigrant Roots to Suburban Dreams: Bernie Madoff’s Early Life and the Allure of Money

Bernard Lawrence Madoff, better known as Bernie Madoff, was the son of Jewish immigrants. His grandparents, escaping hardship in Russia and Poland, built a new life in Laurelton, Queens, on the outskirts of New York City. The mid-20th century offered a stark contrast to their earlier experiences. The U.S. and the world had grappled with the Depression and the devastation of World War II.

After a decade and a half of turmoil, a longing for stability and normalcy permeated American society, fostering a conformist culture, particularly within the burgeoning suburbs. Bernie’s father, Ralph Madoff, reflecting this desire for upward mobility, secured a home for his family in Queens, establishing them within the growing middle class.

Bernie’s parents embodied the working-class spirit of the time. Ralph juggled various jobs, while his wife and mother Sylvia managed the home. Bernie was a public school student who felt slightly out of place among his peers. In his childhood, he attempted to win over a girl who wouldn’t play with him, but when he offered her a quarter, she relented. This experience may have instilled in him the idea of using money as an incentive.

Balancing high school with lifeguarding duties, Bernie harbored a desire to be a protector. Additionally, he displayed an entrepreneurial spirit by selling lawn equipment, demonstrating his early drive for success. He met Ruth Apren when she was 13 years old at a social gathering. Known as his high school sweetheart, Ruth possessed a sharp intellect that led her to pursue college, a path less traveled for women at the time.

Her family background differed from Bernie’s as her father, Saul Alpern, had a successful accounting business that provided a more affluent upbringing. Saul didn’t particularly care for Bernie, believing Ruth could have found a more advantageous match, but Bernie and Ruth’s connection blossomed.

Shifting Gears: From Law to Wall Street

Ralph Madoff envisioned a legal career for Bernie, but after a year at law school, Bernie charted a different course—perhaps feeling the pressure of following in his father’s footsteps. Ralph’s entrepreneurial ventures hadn’t always been successful, and the family faced financial challenges, including a tax lien on their home. Sylvia, traditionally a homemaker, eventually entered the workforce. This experience contrasted with the idealized image of a prosperous suburban life. Bernie, seeking a quicker path, turned his sights on the fast-paced and glamorous world of Wall Street.

The 1960s witnessed a surge of young, ambitious traders and money managers seeking high returns in the post-war market. Shortly after marrying Ruth, Bernie leveraged her father’s accounting firm and his own $5,000 savings to launch Bernard Lawrence Madoff Investment Securities (BLMIS). Ruth played a key role, in managing administrative tasks and finances.

From the outset, Bernie saw himself as a maverick, aiming to disrupt the established system. He focused on over-the-counter (OTC) stocks, a market unknown to many mainstream investors. Unlike the prestigious New York Stock Exchange, the OTC market lacked a central location and relied on networks of dealers and traders communicating via telephone. These “penny stocks” often represented smaller, less established companies, and their value wasn’t readily apparent.

Prior to the era of computers and the Internet, stock transactions were conducted by phone. Investors would agree on prices over the phone and then physically mail stock certificates. The OTC market carried significant risks but also the potential for substantial profits, demanding a certain level of resilience from participants.

In addition to his OTC brokerage business, Bernie saw an opportunity in investment advisory services, offering a way to earn fees on managing client money, potentially more lucrative than commissions from trading. His father-in-law, Saul, began referring clients to him. This initial group of 20-24 people wanted Bernie to manage their investments for a return.

To simplify the process, Saul suggested pooling everyone’s money instead of setting up individual accounts. Bernie would then invest the combined funds and report back the profits, while Saul distributed these profits among the investors, functioning essentially like an unregulated mutual fund. However, regulations required registration with the Securities and Exchange Commission (SEC) for managing more than a certain number of accounts—Bernie, however, did not register.

This early venture into investment advising, operating outside the regulatory framework, foreshadowed future problems in Bernie’s career. His ambition to succeed on Wall Street, possibly fueled by a desire to avoid his family’s financial struggles, led him to take significant risks.

A Risky Gamble Backfires

Bernie invested his clients’ money in high-risk stocks, seeking substantial returns, and exposing his clients’ savings to significant volatility. In May 1962, the stock market experienced a sharp downturn with the speculative stocks plummeting first, wiping out his clients’ investments totaling $30,000.

Faced with this setback, Bernie felt a sense of responsibility as his clients trusted his recommendations. However, instead of admitting the losses, he decided to conceal them, borrowing $30,000 from Saul to repay his clients. This deception created the illusion of success, portraying him as a skilled investor who navigated a difficult market without losses, marking a turning point. Bernie faced a choice: come clean about the losses or continue the charade. He chose the latter, prioritizing the image of success over honesty.

Navigating a Changing Market: From Wholesaler to NASDAQ Pioneer

The turbulent economic climate of the 1970s, marked by the Vietnam War, recession, and rising inflation, significantly impacted Wall Street. Bernie, recognizing the shift, decided to relocate his business to Wall Street itself. He transitioned from a penny stockbroker to a market maker, essentially holding inventories of stocks and selling them to interested buyers while earning a commission per sale. This role required him to facilitate trades regardless of market conditions. Notably, he hired his brother Peter, who played a crucial role in pioneering computerized trading.

The arrival of computers revolutionized Wall Street operations as major players began demanding larger trade sizes, moving from hundreds to thousands of shares. Traditional methods, which could take weeks to finalize trades, became obsolete. Bernie capitalized on this shift by using computerized trading systems, enabling him to process transactions within days. This technological edge allowed him to compete with larger institutional businesses.

However, Bernie’s most significant contribution in this era involved consolidating the over-the-counter (OTC) market, bringing these “pink sheet” stocks, previously scattered across various platforms, onto a single computerized system. This system eventually evolved into the NASDAQ (National Association of Securities Dealers Automated Quotation) and the NASD (National Association of Securities Dealers). In essence, Bernie played a role in legitimizing and streamlining the OTC market.

He continued to benefit from referrals from Saul’s accounting firm, which was later renamed Avelino and Bienes (A&B) after his retirement. A&B, through Frank Avelino and Michael Bienes, began to raise funds for Bernie’s unofficial investment advisory business. They solicited investments from various sources, including corporations, family offices, trust departments, and individuals. These funds were then pooled together and directed to Bernie’s firm. In return for attracting these clients, A&B received a fee.

But A&B’s actions were problematic as they operated as unregistered investment advisors, which is illegal. Essentially, they collected client money without disclosing that it would be managed by an unregulated entity, Bernie Madoff. Their clients were kept in the dark about the true nature of the investment and the person managing their funds.

The 1980s: Prosperity and A Family Business

By the 1980s, Bernie Madoff had established a family life. He and his wife, Ruth, had two sons, Andrew and Mark. The family relocated to Roslyn, Long Island, a prosperous coastal community, reflecting Bernie’s growing financial success. His business flourished and his triumph translated into a more extravagant lifestyle. He and Ruth relocated to a luxurious Manhattan penthouse and acquired a vacation home in Montauk. Membership at a country club, a boat, and other markers of wealth became part of their new reality.

This prosperous period prompted a move to a prestigious office building in 1987 with distinctive architecture earning it the nickname “Lipstick Building.” The firm’s offices were designed to project sophistication and technological advancement.

Initially, the work environment had a familial atmosphere as many employees were relatives or friends of relatives, fostering a sense of comfort and security. Notably, both sons, Mark and Andrew, joined the firm right after college, working on the trading floor. His brother, Peter, held a position as compliance officer and Ruth even maintained an office within the company. Some at the firm jokingly referred to the situation as “nepotism central.”

Bernie presented a complex image. On the one hand, he cultivated a reputation for generosity, supporting charities, offering financial assistance to employees, and participating in philanthropic activities. However, a darker side existed as some saw his generosity as a means of cultivating adoration and loyalty.

He demanded a meticulously controlled environment at work, dictating everything from desk decor to employee interactions. As time progressed, his demeanor grew harsher—prone to intense outbursts and intimidation tactics, fostering fear among his staff. This volatility, described as switching from “loving and caring” to “brutal,” created a tense and unpredictable work environment.

The 1987 Crash and Bernie Madoff’s Rise

The infamous stock market crash of October 19th, 1987, sent shockwaves through Wall Street. Amidst the panic selling, Bernie’s firm stood out. They remained calm and strategically bought stocks while others scrambled to offload them. This decisive action, aided by Bernie’s advanced trading technology, allowed his firm to maintain operations and continue serving clients. His composure during the crisis earned him recognition from the SEC, the New York Stock Exchange, and even Congress.

He played a role in shaping regulations to address future market disruptions, further solidifying his image as a trustworthy and reliable figure. Capitalizing on this newfound reputation, Bernie actively participated in industry boards and regulatory discussions. His leadership qualities culminated in his election to three terms as chairman of the NASDAQ board. By the 1990s, he had become a highly respected figure on Wall Street.

The rise of technology and the internet further fueled Bernie’s success. He leveraged these advancements to streamline his market-making business, capturing a significant portion (around 5-7%) of the total trading volume on the New York Stock Exchange. However, a critical detail remained hidden: Bernie was simultaneously running his secret investment advisory business, completely separate from his public persona.

The Ponzi Scheme: Early Warning Signs

Bernie’s investment advisory service promised consistently high returns for investors, ranging from an initial 11% to as much as 19%. These returns significantly exceeded market averages and never seemed to experience losses. A&B, the feeder fund raising money for Bernie, continued to attract new investors while maintaining a very secretive operation, avoiding any written documentation.

However, a red flag emerged in 1992 when a brochure from A&B advertising “100% safe investments” and “no losing transactions in over 20 years” caught the attention of the SEC, the Securities and Exchange Commission. This claim of risk-free returns raised immediate concerns, as all investments inherently carry some level of risk. The SEC initiated an investigation, focusing on A&B’s activities.

In response, A&B, accompanied by their lawyer, disclosed to the agency that they had raised around $444 million for investment. The substantial amount of money from smaller investors raised suspicions of potential fraud. A&B attempted to deflect scrutiny by stating that all investment decisions were made by Bernie Madoff.

Therefore, the SEC requested documents from Bernie to verify these claims, triggering alarm as his investment advisory business was a sham. He wasn’t actually investing client funds; he was running a Ponzi scheme—a system relying on a continuous flow of new investor money to pay returns to existing investors, creating the illusion of profitability. Faced with the SEC investigation, Bernie needed to fabricate evidence, enlisting the help of a longtime loyal employee, Frank DiPascali—Bernie’s accomplice.

A Narrow Escape: The Inner Workings of the Fraud

Frank was tasked with creating a fabricated paper trail including fake account records, trade logs, and account statements designed to appear legitimate. Bernie presented these documents to the SEC, and despite lacking a thorough investigation, they accepted the fabricated documents as genuine and closed the case. However, they required A&B to shut down its unregistered investment fund and return the raised funds ($444 million) to investors.

Faced with this immediate financial hurdle, Bernie, lacking the actual funds, turned to three of his largest and most successful clients: Jeffry Picower, Carl Shapiro, and Norman Levy. These individuals had significantly profited from Bernie’s purported investment strategies. Bernie successfully persuaded them to provide him with the necessary $444 million, using this money to repay A&B’s investors, but they didn’t request their money back. In fact, upon the closure of the A&B fund, many clients, mostly senior citizens, transferred their investments directly to Bernie’s advisory service, emboldening him to continue his Ponzi scheme.

Despite the red flags raised by the SEC investigation, Bernie remained unregistered as a financial advisor. His business continued to attract new clients, primarily through word-of-mouth recommendations. Within the exclusive world of high-end financial management, Bernie’s reputation grew, and his consistent, seemingly effortless returns fueled a belief in his exceptional skills, bordering on magic for some investors.

The 17th Floor: Dead Drop Zone

As Bernie’s investment advisory business grew, driven by his Ponzi scheme, he needed a dedicated workspace separate from his legitimate operations, prompting him to rent the 17th floor of the Lipstick Building. In stark contrast to the sleek, modern design of the 19th floor, the 17th floor was a chaotic workspace. Filled with outdated computers, mountains of paperwork, and overflowing boxes, it lacked the sophistication of the upper floor. This unkempt environment served as the breeding ground for the Ponzi scheme over the years.

Strict access control was enforced: only authorized employees on the 17th floor were permitted entry. A clear division existed between the 17th and 19th floors, with minimal communication regarding specific work processes. This compartmentalization prevented unwanted scrutiny. Despite being Bernie’s sons, Mark and Andrew expressed interest in understanding the 17th floor’s operations.

However, Bernie remained guarded, denying them access and refusing to discuss the details. This exclusion reportedly caused tension within the family, with whispers of discontent arising among some employees. Ultimately, Bernie maintained his stance, insisting on a clear separation between their business areas.

The Gears of the Scheme: Bernie Madoff’s Unsuspecting Accomplices

Frank, a key figure in the fraud, oversaw the investment advisory side on the 17th floor. While not formally educated, he possessed a talent for system development that proved crucial for the scheme. Bernie valued his resourcefulness and ability to navigate the financial world, but for Frank, the position offered a chance at luxury and wealth beyond anything he could have imagined.

Many 17th-floor employees had joined Bernie early in their careers, fostering a sense of loyalty and a willingness to follow instructions. Annette Bongiorno, a longtime employee on the 17th floor, held Bernie in high regard, governing a dedicated team and playing a crucial role in handling interactions with his high-profile clients. She held a position of trust, managing a petty cash fund and was known for directing others to retrieve money for various needs. Despite her working-class background, she had remained loyal to Bernie for over three decades. Her lifestyle, including frequent trips to Palm Beach and new car purchases, reflected a degree of financial comfort.

Divided into two sections overseen by Frank and Annette, every night a critical task involved generating and mailing out roughly 700 account statements to clients. Maintaining meticulous records was crucial to perpetuate the illusion of legitimate investment activity. They fabricated trades by using historical stock data to create entries that made it appear as if stocks were purchased and then sold for a profit within a specific timeframe.

Jerome O’Hara and George Perez, computer programmers, played a key role, integrating this fabricated trade data into client statements, ensuring a realistic appearance. The sheer volume of clients, however, presented a logistical challenge, transforming the 17th floor into a “paper mill.” Significantly, Bernie never offered clients electronic access to their statements, preventing them from scrutinizing the information provided. The operation essentially mirrored a bookmaker’s, with meticulous tracking of incoming and outgoing funds.

Jodi Crupi, an account supervisor, held a vital position, managing the “Jodi pad,” a daily record of deposits and withdrawals from the JP Morgan Chase account known as “703” (referencing the last three digits of the account number, also known as the Ponzi account). This daily tally, delivered to Bernie at the close of business, provided him with a real-time overview of the cash flow to ensure he had sufficient funds on hand to meet withdrawal requests from investors. By limiting the number of people involved in the scheme helped maintain secrecy for an extended period.

Bernie Madoff House in Palm Beach: New Social Circle, New Victims

Palm Beach, a wealthy enclave known for its philanthropic activities, potentially influenced Bernie’s decision to purchase a house there, marking a shift in his lifestyle. After he and Ruth purchased a home, Bernie secured membership at the Palm Beach Country Club, a social hub known for its acceptance of both Jewish and non-Jewish members—unheard of at the time. This was a significant change from the past, where many clubs in the area had a history of discrimination against Jewish people. Prior to the Civil Rights era of the 1960s, social exclusion and limitations on property ownership were common experiences for Jewish families.

The Palm Beach Country Club, however, represented a more inclusive environment, perfect for Bernie to discover new investors. His integration into the social scene proved beneficial, gaining the trust and admiration of the community, establishing himself as a successful and charitable figure, particularly amongst the Jewish community.

Motivations and Greed: Bernie Madoff and Investors

The promise of consistent and high returns fueled investor interest in Bernie’s advisory service. Many clients were eager to grow their wealth and enthusiastically promoted his services to friends and family, significantly expanding his client base. Some investors, trusting the seemingly proven track record, even entrusted their entire life savings to Bernie.

However, as clients occasionally questioned the delayed arrival of trade confirmations for their supposed investments, Bernie, known for his volatile temper, would react with anger. Oftentimes, he resorted to intimidation tactics, threatening to return their money if they persisted with questions—even refusing to discuss client statements or engage in negotiations. Faced with such hostility, some investors, hesitant to lose their perceived gains, opted to remain quiet. They rationalized their decision based on his long history of seemingly successful investment strategies.

Bernie’s Hedge Fund: Capital Growth

Bernie’s investment business thrived on reputation. He cultivated a network of contacts, granting him access to the burgeoning hedge fund industry. Hedge funds, originally designed to profit from both rising and falling markets, offered a way to “hedge” bets. They became a popular choice for the wealthy, promising high returns with less regulation. Hedge funds proved crucial for Bernie’s Ponzi scheme as they acted as feeder funds, collecting money from other investors and channeling it into Bernie’s firm.

Fairfield Greenwich, a hedge fund co-founded by former SEC regulator Jeffry Picower and Wall Street veteran Walter Noel, came to Bernie through a family connection. He presented his “split-strike conversion strategy” as a complex and sophisticated approach, however, on Wall Street, it was known as a simple “bull spread”—a strategy designed to profit from a rising market while limiting downside risk. Bernie’s obfuscation may have impressed them, but their primary concern was consistent returns.

Adding to the allure, Bernie’s fee structure defied the industry standard. Typically, hedge funds charged a “2 and 20” fee: 2% annual management fee and 20% of profits. Bernie, however, only charged commissions on trades, leaving Fairfield Greenwich with all the profits. This seemingly sweet deal proved irresistible, and they readily signed up.

Bernie, however, preferred a hands-off approach, so when Jeffry’s questions became too probing, he threatened to return their money, effectively silencing further inquiry. This tactic, surprisingly, cemented Fairfield Greenwich’s decision to invest, making the company Bernie’s first major hedge fund client.

His world transformed with Fairfield Greenwich—a privilege attributed primarily to Noel’s five well-connected daughters, married into global wealth, adding a layer of instant credibility for Bernie. Fairfield Greenwich, along with these wealthy in-laws, became Bernie’s gateway to a global network of cash, fueling his fraudulent operation.

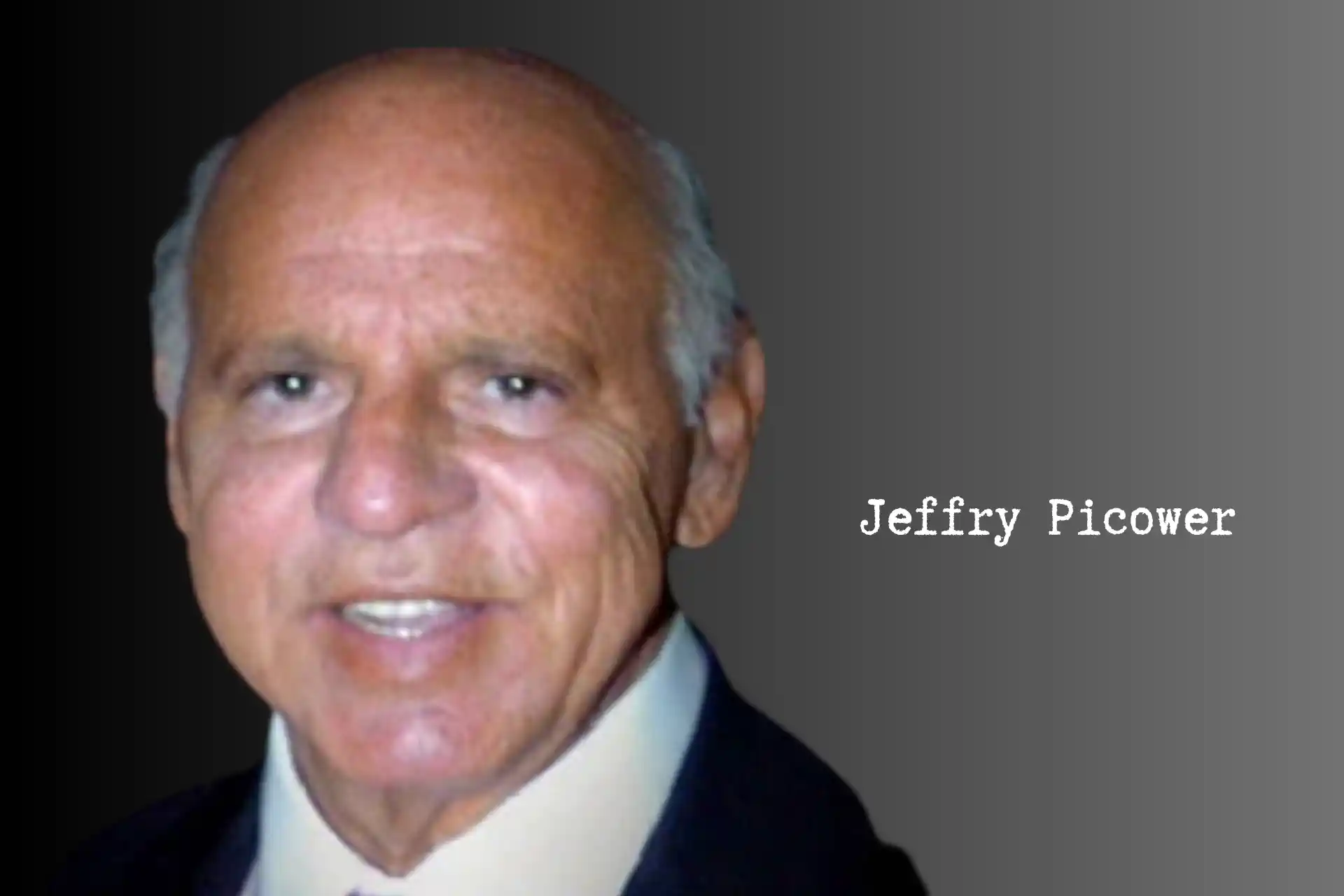

Jeffry Picower: A Longstanding Client, a Double-Edged Sword

Bernie harbored a nagging suspicion—Jeffry might know the truth about the Ponzi scheme. A friend of Bernie’s for over three decades, Bernie adopted a “keep your friends close” approach. Jeffry was a crucial figure in the fraud as he initially invested heavily with Bernie, exceeding $600 million. However, between 1998 and 2003, Jeffry began withdrawing massive sums, totaling a staggering $7 billion.

Bernie was certain he understood the fraud and was exploiting the situation to maximize his own returns, ultimately becoming the biggest beneficiary, surpassing even Bernie himself. This placed immense pressure on Bernie, who needed to find new funds to cover these withdrawals. In a risky move, he allowed Jeffry to tap into the investments of Fairfield Greenwich, essentially withdrawing money that the company had entrusted to Bernie.

While Jeffry continued to invest new funds, his withdrawals created a dangerous dependence for Bernie. During periods of financial stress for the Ponzi scheme, Jeffry’s investments became a lifeline, however, this dependence gave Jeffry significant leverage. This complex dynamic exposed both Bernie’s desperation and the inherent greed that powered the Ponzi scheme.

A House of Cards Built on Fraud: Bernie’s Lavish Lifestyle

Bernie lived a life of exorbitant luxury. The firm sported a private jet, color-coordinated to match the office décor. His family wasn’t immune to the largesse. Ruth, busy organizing lavish charity events, often in Bernie’s honor, enjoyed a life of privilege. Millions in loans flowed freely to his sons, Mark and Andrew, and Bernie even used the scheme’s money to buy houses for employees. This ostentatious lifestyle was a house of cards, built on a foundation of stolen funds.

But the truth was Bernie’s legitimate business was a ticking time bomb. While the trading desks themselves were profitable, they couldn’t support the massive overhead. Bernie, a self-proclaimed people pleaser, employed a bloated staff—over 150 employees for just 35-50 traders. He doled out jobs to friends of key employees, regardless of their actual contribution. This extravagance, fueled by the Ponzi scheme, went far beyond salaries.

A Journalist Unravels the First Threads: The Mystery of Bernie’s Never-Losing Fund

A Barron’s Magazine journalist stumbled upon a suspicious anomaly—Bernie’s hedge fund was unlike any other and seemed immune to market downturns. While the stock market plummeted, Bernie’s fund consistently churned out profits, defying logic and sparking an investigation.

The journalist’s inquiries yielded a string of red flags as Wall Street traders had no dealings with Bernie. Private banks reported that wealthy clients had invested with him, yet under a strict shroud of secrecy—Bernie forbade them from disclosing his involvement. This secrecy was bizarre as most successful portfolio managers crave recognition for their achievements, but not Bernie.

However, a lunch with a banker to the wealthy confirmed the journalist’s suspicions. He couldn’t access Bernie’s books or conduct due diligence, and clients threatened to fire him if he questioned their investments—a pattern repeated with several clients.

The journalist contacted Jeffry—a key figure linked to Bernie—who dismissed her concerns, claiming the fund was private and not relevant to her, however, she wasn’t deterred. She noted that prestigious firms like Goldman Sachs and Salomon Brothers avoided Bernie, unable to decipher the source of his consistent returns.

Assuming Bernie would welcome the publicity, the journalist expected an easy interview, however, repeated attempts yielded no response. Finally, on the eve of publication, she informed him of the upcoming article and suddenly, he became available. Bernie was smooth, surprised, and ultimately dismissive, citing proprietary information as a reason to decline the interview. This reluctance further fueled the journalist’s suspicions, setting the stage for a potential exposé.

The Barron’s article sent shivers down Jeffry’s spine, as billions of dollars were on the line, and he craved reassurance. Feigning nonchalance, Bernie attempted to quell Jeffry’s suspicions, presenting a fabricated trade ledger, but Jeffry wasn’t entirely convinced. Digging deeper, he requested access to an electronic account with the Depository Trust Company (DTC)—essentially a central bank for Wall Street transactions—which would offer a more transparent view of their holdings.

To appease Jeffry, Bernie and Frank resorted to elaborate theatrics as Frank intercepted the real-time feed from the legitimate brokerage firm. He then cleverly weaved fake trades into the data, allowing them to conjure up a fabricated account reflecting Jeffry’s desired holdings. This elaborate stagecraft temporarily relieved Jeffry’s anxieties.

The Software Shell Game: A Programmer’s Dilemma

Thousands of investors were unknowingly victims of a fabricated reality. Their accounts, brimming with fictitious profits, never actually held any real assets. The linchpin of this fraud was the custom software Jerome O’Hara and George Perez had designed, churning out fake account statements, trade confirmations, and client reports, all meticulously crafted illusions.

These programmers, however, became increasingly uneasy with their role in the charade. The fear of exposure gnawed at them, leading them to confront Frank with a peculiar request. Instead of blowing the whistle, they opted for a risky maneuver—blackmail. Demanding a raise, not in cash but in diamonds, they hoped to profit from the very deception they were perpetuating.

Caught in a twisted bind, the programmers documented their anxieties in a note, expressing fear for their safety, triggering a tense meeting with Bernie. They proposed shutting down the entire investment business, a suggestion met with Bernie’s characteristic bullying tactics as he barked, “Shutting down is not an option! Now get the fuck out of my office!”

A One-Page Alarm: Harry Markopolos Smells a Rat

Harry Markopolos, a portfolio manager at Rampart Investment Company, was tasked with a curious mission: crack the code of Bernie’s seemingly unbeatable investment strategy. Rampart, eager to capture market share, wanted to replicate Bernie’s success. However, within just four minutes of reviewing a single page summarizing one of Bernie’s feeder funds, alarm bells went off for Harry. The returns were staggering—a near-impossible 96.4% success rate, with a growth trajectory that resembled a perfectly straight line—a phenomenon unheard of on Wall Street.

These red flags screamed “fraud,” possibly a Ponzi scheme in the making. Despite Harry’s concerns, Rampart dismissed his suspicions—after all, Bernie’s firm handled 7-10% of the US stock market volume, lending him an air of legitimacy. Instead of heeding the warning, they instructed Harry to find a way to mimic Bernie’s “strategy,” a request that would ultimately prove impossible and tragically shortsighted.

Within hours of recognizing Bernie’s scheme, Harry, fueled by conviction, filed a complaint with the SEC on March 1st, 2000. However, persuading them proved an uphill battle. Bernie was a titan on Wall Street and enjoyed a close relationship with the SEC, serving on panels and offering expert advice. In their eyes, he was a pillar of the financial world.

Armed with evidence, Harry tirelessly lobbied the SEC for an investigation, facing repeated rejections, their trust in Bernie outweighing his claims. Undeterred, he widened his net, contacting major publications, yet fear of tarnishing Bernie’s powerful image kept them at bay.

No one at Rampart was interested in the risks he’d uncovered, craving the returns Bernie promised—returns that came with no risk, a proposition too good to be true. His attempts to persuade wealthy European investors were equally futile. Fourteen out of twenty private bankers he met boasted Bernie as their client, leaving Harry with just a handful of investors after months of effort. This lopsided distribution fueled a chilling realization—Bernie’s fraud transcended the U.S.

The Cayman Islands, a haven for tax evasion and money laundering, held the offshore reserves that fueled the scheme. Harry was slowly grasping the horrifying truth—Bernie was managing money for a network of potentially dangerous individuals. The weight of this knowledge was a heavy burden and fear became Harry’s constant companion, prompting him to carry a gun and check his car for explosives. He was preparing for a fight against an invisible enemy, a battle that was far from over.

Bernie’s Bluff: A Whistleblower and a Blind Eye

By the end of 2000, Michael Ocrant, a financial fraud investigator, had a bombshell. Sources, including top options traders and derivatives heads at major banks, whispered the same incredible story: Bernie Madoff seemed to possess an uncanny ability to be out of the market before a downturn and in before an upswing. Everyone knew you can’t predict the market.

Michael, armed with this intel and the fact that Bernie managed over $7 billion, wrote an exposé that a senior SEC enforcement officer noticed. An investigation seemed warranted, especially since Bernie hadn’t registered his investment advisory business. But when they contacted him for a routine exam, Bernie simply denied having a hedge fund—a statement the SEC officer, unbelievably, accepted at face value. Bernie had cultivated a reputation so sterling that even basic scrutiny was met with blind trust. This misplaced faith would have devastating consequences.

A Perfect Storm: 9/11 and the Erosion of Oversight

The aftermath of 9/11 created an unintended haven for Bernie’s scheme. With Wall Street crippled for days, the NASDAQ market, where Bernie held influence, played a crucial role in restoring normalcy. This focus on market stability diverted resources from white-collar crime investigations, which were increasingly overshadowed by counterterrorism efforts. Facing tighter budgets and legislative hurdles, the SEC found its enforcement capabilities hampered, providing a shield for Bernie’s fraudulent operation.

Meanwhile, his legitimate business faced its own challenges. Between 1998 and 2002, competition intensified, squeezing his profit margins in the face of declining commissions. To maintain his facade of success, Bernie resorted to a new tactic: a shell game. Money from the 17th floor was wired to London, then mysteriously reappeared on the 19th floor, disguised as investments in U.S. Treasury bills. This elaborate ruse was crucial for Bernie as a thriving legitimate business upheld his reputation, allowing the Ponzi scheme to flourish in the shadows.

A Dysfunctional Dance: Bernie, Peter, and the Facade of Compliance

As Bernie’s scheme ballooned, so did his paranoia. He craved absolute control, demanding constant updates and radiating a “my way or the highway” attitude. Peter, the younger brother and ostensible Chief Compliance Officer, offered a stark contrast. He fostered a sense of accomplishment in his team, but within the family dynamic, he bore the brunt of Bernie’s volatility. In fact, Andrew, Mark, and Peter walked on eggshells, trying to appease Bernie and prevent his outbursts.

This dysfunctional dynamic raises a crucial question: how much did Peter truly know? As compliance officer, he was tasked with ensuring adherence to regulations and served as the official face of Bernie to the SEC. Did his compliance efforts reflect genuine oversight, or was he willfully blind to the rampant fraud unfolding on the 17th floor? The answer likely lies somewhere in between a mix of fear, loyalty, and a carefully constructed illusion that perpetuated the Madoff myth for far too long.

The Incompetent Investigation: Bernie Outfoxes the SEC

Despite mounting complaints about Bernie’s astronomically high and statistically impossible returns, the SEC’s response was underwhelming. Their “examination” consisted of two fresh-faced, inexperienced examiners who were woefully unprepared for the manipulative mastermind they were about to face. Bernie, ever the charmer, took them under his wing, regaling them with stories and jokes. He kept them under his watchful eye, ensuring they remained in a designated area and that staff promptly catered to their every whim.

As the investigation progressed, while he remained cordial if they focused on his preferred areas, any attempt to delve into the Ponzi scheme was met with hostility. He even contemplated wiretapping his office! During their lunch break, Bernie, unable to contain his paranoia, rifled through the examiners’ briefcases, finding articles by Harry Markopolos and Michael Ocrant questioning the legitimacy of his returns.

This discovery enraged Bernie as he confronted the examiners, demanding to know their true motives. Flustered and intimidated, they admitted to investigating his hedge fund activities. With practiced ease, Bernie weaved a lie, denying the existence of a hedge fund while claiming to simply execute trades for other hedge funds. Astonishingly, the examiners, outmatched and perhaps even intimidated by a man who seemed to know more about the SEC’s operations than they did, closed the investigation, citing a lack of evidence. This colossal failure by the SEC would have devastating consequences, allowing Bernie to continue his Ponzi scheme for years to come.

A Calculated Gamble: Bernie Dodges Another Bullet (2006)

Undeterred by years of rejection, Harry Markopolos contacted the SEC in November 2005. This time, armed with a document overflowing with red flags, he sent an email to the New York Regional Field Office with a subject line that couldn’t be ignored: “The World’s Largest Hedge Fund is a Fraud.” His message was clear: Bernie Madoff’s astronomical returns were simply not possible.

Harry’s evidence was damning as Bernie boasted an unrealistic trading volume, lacking an independent compliance firm—a glaring oversight—and nobody could identify any counterparties for his trades. Faced with this compelling case, the SEC finally took Harry seriously and launched a full-fledged investigation.

Unaware of the scrutiny, Bernie scrambled to contain the damage. He reached out to a compliance officer at Fairfield Greenwich, a major investor, instructing them on how to handle potential SEC inquiries. Little did Bernie know Fairfield had been recording their conversations. This recorded call, where Bernie essentially advised Fairfield to blindly trust him, would later become a crucial piece of evidence in exposing the fraud.

Sensing the SEC’s suspicion after coaching the Fairfield compliance officer, Bernie decided on a risky maneuver. He called them directly, proposing a meeting—no lawyers, just him and their questions—a calculated gamble. At the meeting, Bernie readily provided a list of banks where he supposedly traded options. He even offered his DTC account number for verification—a move that should have exposed the emptiness of his claims. The weekend that followed was agonizing for Bernie, envisioning his fraud collapsing as the SEC contacted his fictitious counterparties and discovered the missing billions.

Yet, Monday arrived, and silence. The SEC, in a display of astonishing incompetence, never followed up on Bernie’s information, but instead, concluded that his answers were satisfactory. In 2006, they even allowed Bernie to register as an investment advisor, a supposed stamp of approval that Bernie eagerly used to attract even more investors. This monumental failure on their part had devastating consequences as billions of dollars poured into the scheme, further enriching Bernie and prolonging the inevitable day of reckoning.

The Party Ends: The Housing Crisis and Bernie’s Desperation (2007)

The year 2007 marked a turning point as Bernie, seemingly unscathed from the previous investigation, reveled in his success—luxurious private jet trips, a brand new yacht, showering wealth on himself and his inner circle. On the 17th floor, Frank DiPascali saw his salary double, and raises flowed freely. This was the pinnacle of Wall Street excess, a world where success for one often meant exploitation of others.

Meanwhile, a storm was brewing on the horizon as the housing market was imploding. Risky mortgages, sold to unqualified buyers, had been packaged into seemingly secure investments (AAA-rated!) by Wall Street firms. As homeowners began defaulting in droves, the precarious Ponzi scheme began to crumble. Banks teetered on the brink of collapse, and a massive bailout loomed.

While Bernie vacationed in France, oblivious to the impending disaster, his fraud faced a serious threat. Investors, sensing the turmoil in the markets, panicked and redemption requests poured in, a deluge Bernie couldn’t contain. His desperate pleas to clients to hold on or even reinvest fell on deaf ears. Staring at a $1.5 billion hole in his reserves, he only had $300 million to cover it. Bounced checks and a potential public collapse loomed large.

A tense conversation with Frank revealed the full extent of Bernie’s desperation. They were drowning in debt, with no life rafts in sight. Frank, for the first time, glimpsed the horrifying truth that Bernie had no hidden assets, no magic solution—it was all a monstrous lie. In a final act of self-preservation, Bernie proposed using the remaining funds to pay off select clients, including family and loyal employees.

As the financial crisis deepened, he was desperate to plug the hole in his Ponzi scheme, instructing Frank to prepare a batch of checks. Little did Mark and Andrew know that these weren’t bonuses, but a desperate attempt to appease a few key investors. The timing amidst market turmoil raised red flags for the brothers as they urged Bernie to hold off, but their pleas fell on deaf ears.

On December 10th, the facade finally shattered. Cornered and unable to sustain the charade any longer, Bernie confessed his monstrous secret to his family at their penthouse—revealing the truth, a multi-billion dollar Ponzi scheme fueled by lies. The remaining $300 million, the source of the intended checks, was all they had left. Andrew’s world crumbled around him, tears streaming down his face. Ruth, oblivious to the intricacies of finance, simply asked, “What’s a Ponzi scheme?”

The revelation shattered the family. Mark and Andrew consulted a lawyer and learned that disbursing the remaining funds would make them accessories to the crime. With heavy hearts, they turned their father in and the next morning, the FBI arrived at Bernie’s apartment. In his bathrobe, he readily admitted to orchestrating the Ponzi scheme, naively believing he could limit the blame by claiming he acted alone. He spilled his guts to the FBI for two hours, revealing the intricate web of deceit he had spun for years.

With bail set at a staggering $10 million, news of Bernie’s arrest sent shockwaves through the financial world. Public outrage intensified when it was revealed he had received bail—a privilege seemingly unavailable to those who had lost everything. The media painted him as a fallen angel, a man whose reputation was built on lies. Chaos erupted at Bernie’s firm as clients, fearing the worst, flocked to the lobby, demanding answers.

The human cost of Bernie’s fraud was devastating as thousands of people, from retirees forced back into the workforce to those who lost their life savings, were left in financial ruin. The scandal cast a dark shadow over the Jewish community, as Bernie’s own faith became a target for misplaced anger. Suicides, shattered dreams, and billions of dollars in losses were the grim consequences of Bernie’s insatiable greed. His name became synonymous with one of the most audacious financial frauds in history.

Busted: The FBI Unravels Bernie’s Web of Deceit

The FBI’s investigation into Bernie took a dramatic turn when they began interviewing employees. A discrepancy emerged as whispers of a “17th floor” that remained curiously absent from the firm’s official layout. Intrigued, the agents ventured into the previously unknown territory, greeted by utter chaos. Boxes overflowed with documents; papers littered the floor—a stark contrast to the meticulously organized office on the 19th floor. Realizing they had stumbled upon a potential crime scene, the FBI immediately secured the floor and launched their investigation.

However, the sheer complexity of Bernie’s scheme demanded an insider’s perspective. Frank, Bernie’s longtime right-hand man, facing his own legal jeopardy, decided to cut a deal. He became the government’s key informant, providing a roadmap to the complicated workings of the Ponzi scheme. His confession revealed there were no real investments and Bernie’s operation was fake, built on a foundation of stolen funds.

Bernie Madoff Appeal Bond: Where was Bernie Madoff Jailed?

On March 12, 2009, Bernie walked into court and pled guilty to all charges—a decision, some believe, was a calculated move—a desperate attempt to shield his family from further scrutiny. By taking sole responsibility, Bernie hoped to divert attention away from others who might have played a role in the scheme, particularly large banks and institutional investors who could have, but didn’t, raise red flags.

Despite his guilty plea, Bernie’s request for continued bail until sentencing was denied. The initial judge, Denny Chin, denied bail citing Bernie’s age, the severity of his crimes, and the potential for flight risk. Bernie’s lawyers argued that he should remain under house arrest due to the strict monitoring he was under.

However, the 2nd U.S. Circuit Court of Appeals upheld the lower court’s decision and denied Bernie’s appeal for bail. They agreed that he posed a flight risk given his age (70 at the time), the potential for a lengthy sentence, and the means and opportunity to flee. He was sent directly to Manhattan Correctional Center, his gilded cage replaced by the harsh realities of prison life.

Prosecutors, however, remained skeptical of Bernie’s claim of being a lone wolf. They pushed for a plea bargain, hoping he would implicate others involved in the fraud. Andrew, Mark, and even Ruth came under scrutiny. The FBI, particularly suspicious of Ruth’s meticulous record-keeping—perfectly organized tax returns, bank statements, and detailed property listings—investigated her role.

However, they ultimately concluded that Ruth lacked the financial knowledge to have knowingly participated in the scheme. Her meticulousness was simply an extension of her personality, not a cover for her involvement in the fraud.

Bernie Takes the Fall: A Sacrifice to Save Others? (2009)

On March 12, 2009, Bernie walked into court and pled guilty to all charges—a decision, some believe, was a calculated move—a desperate attempt to shield his family from further scrutiny. By taking sole responsibility, Bernie hoped to divert attention away from others who might have played a role in the scheme, particularly large banks and institutional investors who could have, but didn’t, raise red flags.

Despite his guilty plea, Bernie’s request for continued bail until sentencing was denied. He was sent directly to Manhattan Correctional Center, his gilded cage replaced by the harsh realities of prison life.

Prosecutors, however, remained skeptical of Bernie’s claim of being a lone wolf. They pushed for a plea bargain, hoping he would implicate others involved in the fraud. Andrew, Mark, and even Ruth came under scrutiny. The FBI, particularly suspicious of Ruth’s meticulous record-keeping—perfectly organized tax returns, bank statements, and detailed property listings—investigated her role. However, they ultimately concluded that Ruth lacked the financial knowledge to have knowingly participated in the scheme. Her meticulousness was simply an extension of her personality, not a cover for her involvement in the fraud.

Blame Game and Missed Opportunities

A congressional investigation into the SEC became a platform for Harry Markopolos, the whistleblower whose warnings had fallen on deaf ears. Sitting next to a sea of skeptical media, Harry presented his case, detailing the numerous written submissions he had sent the SEC between 2000 and 2008, each one a red flag ignored. His testimony was scathing, a public dressing down of the agency that had failed to act. Embarrassment and fear hung heavy in the air as Congress tore into the SEC for its colossal failure.

While the SEC bore the brunt of public scorn, JP Morgan Chase emerged with troubling questions to answer. They were the only bank with a direct view into Bernie’s web of deceit—a specific checking account known as “ending in 703.” Financial records revealed that between 2003 and 2008, this account consistently held a staggering $3-$6 billion, which wasn’t just unusual—it was a glaring red flag that should have screamed “money laundering!”

Under the Bank Secrecy Act, JP Morgan Chase was legally obligated to investigate such activity. For transactions exceeding $10,000, where the purpose remained unclear, banks are required to file Suspicious Activity Reports (SARs)—a crucial tool for identifying financial crimes. Yet, billions of dollars flowed through Bernie’s account without triggering a single SAR. The media pounced on this revelation, which ultimately contributed JP Morgan Chase having to pay a $2 billion fine in connection with the Madoff case.

However, the outrage went deeper. Despite admitting their culpability in a multi-billion dollar fraud, no individual within the bank faced criminal charges, not even a jail sentence. Further outrage arose when it became clear that JP Morgan Chase didn’t have to disclose the profits they made by handling Bernie’s accounts. The penalty was a slap on the wrist, a financial inconvenience that allowed them to continue business as usual.

Irving Picard: The Madoff Claw-Back Who Nickel-and-Dimed Victims

Irving Picard emerged as a beacon of hope for defrauded investors. Appointed as the trustee for the liquidation of Bernie’s firm, Irving embarked on a relentless mission to recover stolen funds. Working alongside his legal team, he clawed back a staggering $14.5 billion as of November 2021. This represents a monumental effort to recoup losses and provide some measure of financial relief to victims.

Irving suspected Jeffry Picower of acting as a co-conspirator, essentially enabling the schemes. Jeffry, it turned out, had profited more than any other individual from the Ponzi scheme—receiving outrageous annual returns as high as 950% on Bernie’s investments in a time when average returns on the market were only about 9%.

However, after this news was released to the media, Jeffry was found dead at the bottom of his swimming pool. Investigators initially addressed his death as a drowning or suicide, but the autopsy revealed he suffered a heart attack. Despite his death, Irving sued Jeffry’s wife, Barbara, who was ultimately forced to return a staggering $7.2 billion. This wasn’t an isolated case as other prominent investors, the “big four” as they were known, were also implicated. The estates of Norm Levy and Stanley Chais were forced to return $220 million and $277 million respectively, while Carl Shapiro forfeited $625 million.

While Irving’s efforts recovered a significant amount in losses, the process itself became a cause of frustration and despair. Some of the recovered funds came from a controversial source—legal actions against some investors to pay back others. This essentially mirrored the structure of the original Ponzi scheme, leaving a sour taste in many victims’ mouths. They were essentially being victimized again, forced to navigate a complex legal labyrinth with their lives on hold.

Clients who had withdrawn more money than they initially invested were forced to repay those “profits,” even if they represented fictitious returns in the first place. This added financial strain to an already devastating situation. Years were spent dealing with lawyers, leaving victims unable to plan for the future they had envisioned. These were not mere investment losses; they were life savings stolen. Many victims, in their 70s, were forced to abandon retirement and re-enter the workforce. Some faced lawsuits for their IRAs and homes, further compounding their misery.

To add insult to injury, the astronomical fees charged by Irving’s legal team added another layer of outrage. Over a billion dollars went into their pockets, leaving many questioning the fairness of a process that enriched some while leaving others with crumbs. Irving emerged a wealthy beneficiary from the very tragedy he was supposed to alleviate.

Sentenced: Bernie Madoff Funeral Rejected by Family

June 2009 marked a grim chapter in the Bernie saga. Victims’ voices were laced with pain and anger as they delivered powerful impact statements in court, detailing the devastating impact of his fraud. Their stories served as a stark reminder of the lives shattered by his lies.

The judge, acknowledging the immense scale of the crime, imposed the maximum penalty: 150 years in prison. This sentence, while symbolic, could never truly compensate for the stolen dreams and lost security, but Bernie’s fate was sealed. He ultimately died in prison in 2021 at the age of 82. Bernie being cremated, a rejection of his Jewish faith, served as a final, defiant insult. Even in death, the family refused to accept his ashes, a physical manifestation of their rejection of the man who had brought them shame and disgrace.

The quest for accountability extended beyond Bernie. Prosecutors, working with Frank DiPascali, turned their sights on Bernie’s inner circle—the team on the 17th floor who had knowingly facilitated the scheme. Years of investigation resulted in indictments and sentences:

• Annette Bongiorno and Jodi Crupi, key figures in the scheme, received 6 years each.

• Jerome O’Hara and George Perez, who played lesser roles, were sentenced to 2.5 years.

• Peter Madoff, Bernie’s brother, received a 10-year sentence for his involvement.

Frank DiPascali, however, never faced justice. He died of lung cancer before his sentencing, taking his secrets to the grave.

A Life in Ruins: The Madoff Family’s Tragic End

Bernie’s arrest sent shockwaves through not just the financial world, but also his own family. Andrew and Mark, initially portrayed as potential co-conspirators, faced a relentless media onslaught. Public scorn and accusations were heaped upon them, leaving them reeling in disbelief and horror.

The revelation of Bernie’s crimes tore the family apart. His sons, unable to reconcile their father’s actions, confronted Ruth, presenting her with a stark ultimatum: choose between them and Bernie. Torn between the sons she raised and the husband she’d known since childhood, Ruth found herself caught in an impossible situation. Years of shared history made it impossible for her to completely abandon Bernie, especially during his darkest hour. This decision fueled months of bitter conflict. Andrew and Mark was consumed by anger and betrayal, refusing to see their mother.

Mark, in particular, spiraled downward as the constant accusations and lack of escape became unbearable. Tragically, on the second anniversary of the day Bernie confessed his Ponzi scheme, 46-year-old Mark took his own life by hanging himself in his apartment. He left behind four children, the weight of his father’s crimes a tragic burden he couldn’t carry.

Ruth, filled with regret, expressed remorse for not siding with her sons. Andrew, devastated by his brother’s suicide, spoke to the media about their bond and his desire to help Mark, and emphasized utter disdain for his father:

What he did to me, my brother, my family is unbelievable. What he did to thousands of other people, destroyed their lives. I’ll never understand it. I’ll never forgive him. I’ll never speak to him again.

Mark’s suicide was a devastating blow, but in the aftermath, Andrew and Ruth united in grief, finding solace in each other’s company. However, Andrew’s own health struggles added another layer of tragedy. The cancer he’d previously overcome returned, this time with renewed ferocity. In the end, he held Bernie responsible, convinced that his father’s crimes had hastened both his brother’s death and his own illness. Refusing all contact with Bernie, even on his deathbed, Mark died six years after Bernie’s arrest, at the age of 48, leaving Ruth utterly alone.

Stripped of her sons and facing the harsh reality of Bernie’s lifetime of lies, Ruth found herself facing financial ruin. Federal marshals seized all their properties—homes and apartments—leaving her homeless. The life of luxury she had known was gone, replaced by the harsh sting of destitution. Numb and shell-shocked, she lived out of suitcases in the back of her car, a stark contrast to the opulent life she once led.

Before he died in prison, Bernie expressed a semblance of grief, but it was a self-serving sorrow. He mourned the loss of his family’s adoration, not their love. His need for their admiration revealed that Bernie was incapable of genuine love; he craved the validation and status that came with being worshipped. His narcissism and sociopathy, the very traits that fueled his crimes, ultimately led to his family’s destruction.

Similar “White-Collar Crimes” Stories

- Elizabeth Anne Holmes’ Billion Dollar Hoax: Silicon Valley’s Health Hustler

- Dr Paolo Macchiarini: Regenerative Plastic Organ Fraud

- Sam Bankman-Fried: Rise and Fraud of the Pied Piper of Crypto

Bernie Madoff Grandchildren Net Worth

It’s safe to assume that their financial situation has been significantly impacted by their grandfather’s crimes and the subsequent fallout. Many of Madoff’s victims were close friends and family members, including some of his grandchildren. The collapse of his Ponzi scheme resulted in the loss of billions of dollars for these individuals, drastically changing their financial futures.

While some grandchildren may have inherited assets from their parents or other family members, it’s likely that any wealth they possess is significantly less than what they would have had if not for the Ponzi scheme. Additionally, the stigma associated with their grandfather’s crimes may have affected their career prospects and earning potential.

It’s important to note that some of Madoff’s grandchildren have publicly distanced themselves from their grandfather and his actions. They have changed their last names and sought to build their own lives and careers, separate from the Madoff legacy.

Bernie Madoff Business Cards

Bernie Madoff’s business cards are now collector’s items due to his notoriety as the orchestrator of the largest Ponzi scheme in history. The cards typically featured his name, title (Chairman, Bernard L. Madoff Investment Securities), and contact information. Some versions also included the company logo.

These seemingly ordinary cards now represent a dark chapter in financial history. They are sold at auctions and online marketplaces, often fetching high prices due to their historical significance and the infamy of their owner.

The Fall of a Titan: A Legacy of Greed and Betrayal

The Madoff saga serves as a cautionary tale, a chilling reminder of the human cost of greed and deceit. Lives were shattered, dreams destroyed, and a family left in ruins—a tragic consequence of a man’s insatiable hunger for power and control.

The case exposed a fundamental injustice as innocent investors, who had done their due diligence and entrusted their hard-earned money with a seemingly reputable firm, were left with nothing. The process of recovering some funds further burdened them, raising questions about the effectiveness of the system designed to protect them.

This scandal uncovered flaws in the financial system, highlighting the ease with which a determined fraudster could exploit weaknesses in oversight. Beyond Bernie’s crimes, the case also raised critical questions about accountability. While many individuals lost everything, powerful institutions seemingly walked away with a fine—a blatant reminder of the uneven scales of justice.

Watch “Bernie Madoff In His Own Words”

“Bernie Madoff: In His Own Words” recounts the greatest financial deception in history, narrated by those who lived it: the victims, employees, family, investigators, and even Madoff himself.

Read “Betrayal: The Life and Lies of Bernie Madoff”

Betrayal: The Life and Lies of Bernie Madoff by Andrew Kirtzman: This biography delves into Madoff’s personal life, his rise to prominence on Wall Street, and the unraveling of his carefully constructed facade. It offers insights into the man behind the scheme and the factors that contributed to his downfall.

Read “No One Would Listen: A True Financial Thriller”

No One Would Listen: A True Financial Thriller by Harry Markopolos: This book is written by the man who tried to warn the SEC about Madoff’s fraud for years but was ignored. It offers a unique perspective on the investigation and the missed opportunities to stop Madoff sooner.

Read “The Wizard of Lies: Bernie Madoff and the Death of Trust”

The Wizard of Lies: Bernie Madoff and the Death of Trust by Diana B. Henriques: This comprehensive book delves into the intricate details of Madoff’s Ponzi scheme, his motivations, and the devastating impact it had on his victims. It’s a well-researched and engaging read that provides a deep understanding of the case.

FAQs

What did Bernard Lawrence Madoff do with the money?

Bernard Lawrence Madoff used the money from his Ponzi scheme to pay returns to earlier investors, fund his luxurious lifestyle, and cover operating costs, without actually investing it.

Did Bernard Lawrence Madoff die?

Yes, Bernard Lawrence Madoff died on April 14, 2021, while serving his prison sentence. He passed away at the age of 82 from natural causes at the Federal Medical Center in Butner, North Carolina.

How rich was Bernie Madoff at his peak?

Bernie Madoff’s personal wealth at his peak was estimated to be around $126 million. However, this figure is significantly smaller than the total amount of money involved in his Ponzi scheme, which reached an estimated $65 billion.

What happened to Bernie Madoff after his arrest?

After being arrested in December 2008, Bernie Madoff was sentenced to 150 years in prison for his role in the Ponzi scheme, marking the end of his career as a notorious financial criminal.