White collar crime refers to non-violent, financially motivated offenses typically committed by individuals in positions of trust or authority within businesses or government organizations. These crimes often involve deceit, concealment, and manipulation to obtain or avoid losing money, property, or gain an advantages.

Table of Contents

Types and Examples of White Collar Crimes:

These are the types of white collar crimes, Each type will be discussed in further detail below:

1- Embezzlement:

Misappropriation of funds entrusted to an individual by their employer.

Examples: A company employee siphoning money from corporate accounts, or a financial advisor misusing client funds.

Impact: It undermines trust and can lead to substantial financial losses for the victims

2- Corporate Fraud:

Deception or misrepresentation for personal gain, such as insurance fraud, credit card fraud, or investment scams. Corporate fraud, such as falsifying financial statements or insider trading, is a prime example of white collar crimes.

Examples: Falsifying financial statements, insider trading, and accounting fraud.

Impact: Corporate fraud can lead to significant financial losses for investors and damage the credibility of businesses.

3- Insider Trading:

Using confidential information to gain an unfair advantage in the stock market. Congress insider trading scandals highlight a troubling form of white collar crimes, where lawmakers misuse privileged information for personal financial gain.

Examples: Executives or employees trading stocks after learning about an upcoming merger or financial performance before it becomes public knowledge.

Impact: This practice is illegal and can distort market fairness, leading to an uneven playing field for investors.

4- Money Laundering:

Concealing the source of illegally obtained money by passing it through legitimate businesses or investments. A common white collar crimes is the use of a social status money laundering scheme, where individuals exploit their reputation and networks to conceal illicit funds as legitimate wealth.

Examples: Moving money through complex financial transactions, offshore accounts, or shell companies to obscure its source.

Impact: Money laundering facilitates other criminal activities and weakens financial systems.

5-Tax Evasion:

Deliberately underreporting or omitting income to avoid paying taxes.

Examples: Underreporting income, inflating deductions, or hiding money in offshore accounts.

Impact: Tax evasion reduces government revenue, which can affect public services and lead to increased tax burdens on law-abiding citizens.

6- Bribery and corruption:

Offering, giving, receiving, or soliciting something of value to influence an official act

Examples: Paying a government official to secure contracts or influence legislation, or offering kickbacks in a business deal.

Impact: Bribery and corruption erode trust in institutions and can lead to unfair advantages and societal inequity.

7- Identity Theft :

Definition: Identity theft involves the unauthorized use of someone’s personal information to commit fraud or other crimes.

Examples: Using stolen credit card information, hacking personal accounts, or applying for loans in someone else’s name.

Impact: Identity theft can cause significant financial and emotional distress for victims and lead to long-term damage to their credit and reputation

Penalties for White Collar Crimes:

The penalties for white collar crimes vary depending on the specific offense, its severity, and the amount of financial loss involved. However, they can include:

• Fines: Often substantial, intended to deter future offenses and recoup losses.

• Imprisonment: Ranging from months to years, depending on the severity of the crime.

• Restitution: Repayment to victims for their financial losses.

• Forfeiture of assets: Seizure of property or assets acquired through illegal activity.

• Professional sanctions: Loss of licenses, certifications, or employment opportunities.

White collar crimes can have devastating consequences, causing significant financial losses for individuals, businesses, and the government. It erodes public trust in institutions, undermines the integrity of markets, and can even impact the stability of the economy.

Fight against White Collar Crimes:

The fight against white collar crimes involves a multi-pronged approach, including:

• Stronger regulations and oversight: Stricter rules and increased scrutiny of financial transactions.

• Improved technology and data analytics: Utilizing advanced tools to detect patterns and anomalies that may indicate fraudulent activity.

• Whistleblower protections: Encouraging individuals to report wrongdoing without fear of retaliation.

• Enhanced international cooperation: Sharing information and coordinating investigations across borders to tackle global white collar crime networks.

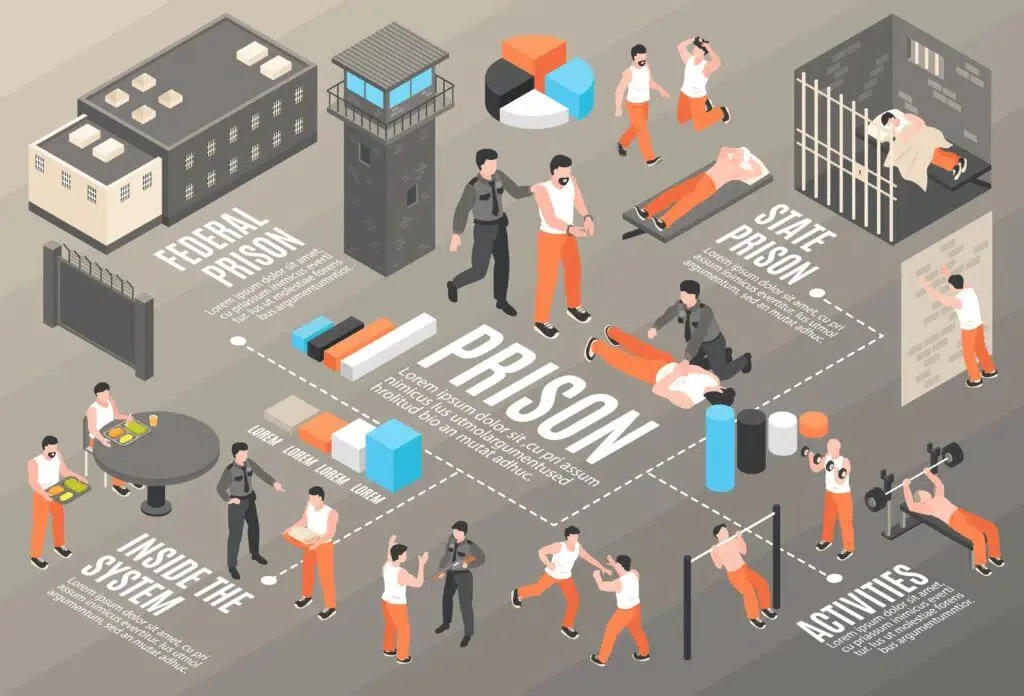

White Collar Crime Prisons: Prisons for White Collar Crimes

Minimum-security prisons typically have dormitory-style housing, more relaxed security measures, and limited or no perimeter fencing. Inmates are typically assigned jobs, such as janitorial work or kitchen duties, which pay a nominal wage. Although there’s more freedom of movement compared to higher security prisons, inmates still have a strict schedule and limited access to the outside world. Daily life can be monotonous, with limited recreational activities and a lack of intellectual stimulation. Adjusting to a new social hierarchy and interacting with individuals from diverse backgrounds can be difficult.

Club fed; White collar criminals, convicted of non-violent financial crimes, often serve their sentences in minimum-security prisons, sometimes referred to as “camps” or “Club Fed.” While these facilities may lack the harshness of maximum-security prisons, they still represent a significant loss of freedom and a challenging adjustment for those accustomed to privilege and comfort.

Individuals used to positions of power and prestige may struggle with the loss of their former identities and social standing. Adjusting to the prison environment, with its strict rules and lack of privacy, can be jarring for those accustomed to a comfortable lifestyle. The shame associated with a white collar conviction can lead to feelings of isolation and depression. Many white collar criminals face financial ruin due to fines, restitution, and legal fees, adding to the stress of incarceration. Finding employment and rebuilding a life after release can be challenging with a criminal record.

Preventions of White Collar Crimes in Business:

- Hiring and training processes.

- Start with your hiring process.

- Strong internal controls.

- Create strong internal controls in your organization to stop fraud.

- Vendor and supplier due diligence.

- Corporate measures.

White Collar Crime Factors:

The severity of the crime, criminal history, and other factors can result in placement in higher-security facilities. While conditions may be less harsh, prison life is still challenging and can have long-lasting consequences. Many white collar prisons offer programs to help inmates address the underlying causes of their criminal behavior and prepare for successful reentry into society.

Similar “White Collar Crime” Stories

- Sam Bankman-Fried: Rise and Fraud of the Pied Piper of Crypto

- Bernard Lawrence Madoff: The Architect of the Largest Ponzi Scheme in History

- Dr Paolo Macchiarini: Regenerative Plastic Organ Fraud

Books about the “White Collar Crimes”

Read “Why They Do It Inside the Mind of the White-Collar Criminal”

Forget the simplistic explanations of greed and ambition. In Why They Do It, Professor Eugene Soltes offers a groundbreaking exploration of white-collar crime, drawing on extensive interviews with convicted executives and insights from psychology, criminology, and economics. This book challenges conventional wisdom, revealing the surprising factors that contribute to the downfall of once-respected leaders.

Read “White Collar and Financial Crimes A Casebook of Fraudsters, Scam Artists, and Corporate Thieves”

This book offers a captivating look into the world of white collar crimes through real-life case studies, providing insights into its detection, investigation, and prosecution. From high-profile scandals to lesser-known cases, it equips students with the knowledge and tools needed to navigate the complexities of this field.

Read “Bad Blood: Secrets and Lies in a Silicon Valley Startup”

“Bad Blood: Secrets and Lies in a Silicon Valley Startup” by John Carreyrou:This riveting exposé uncovers the shocking fraud behind Theranos, a blood-testing company once valued at billions, and its charismatic founder, Elizabeth Holmes.

Read “The Informant: A True Story”

“The Informant” by Kurt Eichenwald:This captivating true story follows Mark Whitacre, a high-level executive turned whistleblower, as he exposes a massive price-fixing conspiracy at Archer Daniels Midland

Watch “Enron The Smartest Guys in the Room”

“Enron: The Smartest Guys in the Room” (2005):This Oscar-nominated documentary dissects the rise and fall of Enron, revealing the corporate greed, accounting fraud, and political manipulation that led to one of the biggest business scandals in history.

Conclusion:

In the world of white collar crimes, awareness is the strongest shield. By understanding its intricacies, businesses can fortify their defenses and protect their integrity. Vigilance and education are the best tools against these unseen adversaries.

FAQs

What is the most common white collar crime?

Fraud. Fraud is one of the most common forms of white collar crimes, encompassing a wide range of deceptive practices aimed at obtaining money, property, or services through deceitful means

Who discovered white collar crime?

Edwin Sutherland

A sociologist and criminologist, Edwin Sutherland, invented the phrase “white collar crimes” in 1939. Prior to his writings on the subject, many people resisted believing that members of the “upper class” engaged in criminal activity

What is the difference between street crime and white collar crime?

Street crime is any criminal offense that typically takes place or originates in a public place.

White collar crimes are non-violent crimes committed by business or government professionals for financial gain.

How can white collar be controlled?

White collar crimes are policed in three different ways:

1-The criminal justice system

2-The regulatory system

3-Self-regulation